-

The commercial passion fruit (Passiflora spp.) industry in the US and its territories is poorly understood. While production estimates exist[1,2], little is known about who grows this fruit and how it is managed. Annual worldwide production of passion fruit reached around 1.468 mt in 2015-17[3], with the top-producing countries being Brazil (0.948 million mt), Ecuador (0.150 mt), Indonesia (0.114 mt), Vietnam (0.020 mt), and Thailand (0.01 mt). Although Brazil has about two-thirds of the global passion fruit production, most fruits sold domestically[3] are processed into fruit drinks. Ecuador is the largest exporter of processed passion fruit juice[4], but growing global interest in this specialty crop may provide opportunities for expansion outside of traditional production areas. The US passion fruit industry is small but has substantial potential to increase rapidly as consumer awareness of the fruit and processed products grow[1]. Data from the United States Department of Agriculture National Agricultural Statistics Service[2] Census of Agriculture indicated Hawaii had 203 farms, California 82 farms, and Florida 73 farms, but other states also had production[5].

The total US acreage devoted to passion fruit growing has been rising since 1997. The US Agricultural Census[2] data showed that passion fruit operations were 84 in 1997, 66 in 2002, 129 in 2007, 153 in 2012, and 364 bearing and non-bearing farms in 2017. The number of bearing US passion fruit farms reported rose from 43 in 2002, 121 in 2007, 131 in 2012, and 259 in 2017[2]. In 2017, the number of US passion fruit-bearing and non-bearing operations was mainly in Hawaii (203), California (82), and Florida (73), with one or two operations in Alabama, Kentucky, Tennessee, and Texas[2]. The total US passion fruit acreage rose from 53 in 2002, 93 in 2007, 125 in 2012, and 209 in 2017[3]. US farms' average passion fruit-bearing acreage fell from 0.74 acres in 2002 to 0.51 acres in 2017. The same trend was shown with US farms' average non-bearing passion fruit acreage, from 0.84 acres in 2002 to 0.55 acres in 2017.

To our knowledge, there has never been a comprehensive survey of passion fruit production in the US, so little is known about the market value of passion fruit in any of the production regions[1]. According to the 2017 US Census of Agriculture[2], the total number of farms of bearing and non-bearing age was 364 on a total of 85 acres, with the average farm having less than a 1/3 acre. This statistic underestimates actual production since Florida and California produce as much as 400 acres[6,7]. Many more acres were likely planted into passion fruit since this census. Passion fruit is best grown in warm tropical climates; therefore, few states have suitable conditions for the crop. Southern Florida is one of the best production areas[8], but other states, such as California, Hawaii, Louisiana, and Texas, have regions where production occurs or may have production potential.

Purple passion fruit (P. edulis f. edulis) is the predominant type grown in Florida and California[1]. The purple and red hybrid fruit tends to be sweeter and less acidic but can vary by growing conditions and variety[9]. While purple, yellow (P. edulis f. flavicarpa), and intraspecific hybrids of the two are the most common, other edible passion fruit species exist. The market potential for other species in the US is unknown, but establishing a more robust industry based on P. edulis types may lead to other opportunities for an expanded range of species in the future.

While the trend for production is positive[5], current assessments of stakeholder priorities are necessary to describe the passion fruit industry. In 2021, the US Department of Agriculture-National Institute of Food and Agriculture (USDA-NIFA) funded a Specialty Crop Research Initiative (SCRI) grant to survey the passion fruit industry and gain feedback from stakeholders[1]. The survey consisted of two data sets concerning (a) farm characteristics and (b) owner/grower characteristics, the former of which has already been published[1]. Here we report the second data set gathered during this project, detailing the owner/grower characteristics and farm characteristics not discussed in an earlier publication[1]. Understanding the socioeconomic characteristics of growers/owners provides horticulture researchers and specialists with better insights into the underlying human dimensions of the industry[10].

-

An online survey was presented to passion fruit growers and those interested in growing passion fruit in suitable regions of the US. The passion fruit survey was distributed from March through May 2022. The states and territories that had responses included Puerto Rico, the US Virgin Islands, Florida, Mississippi, Louisiana, California, and Hawaii. Extension agents and specialists in each state helped distribute the survey to interested individuals. Some participants preferred to complete the survey via interview with extension personnel due to a lack of internet access. Institutional Review Board (IRB) approval was granted by Mississippi State University, Office of Research Assurances to the project 'Exploring the Potential of Passion Fruit in Subtropical North America' (IRB 21204). Data were collected digitally in Qualtrics, and the data was cleaned and coded (We checked the responses for inconsistencies and skipped answers. The responses were then categorized into numbers to allow for easy analysis and comparison) within Excel.

The survey's 45 questions included topics such as demographic information, production practices, marketing, and obstacles to profitability. The survey was available in both English and Spanish. Respondents were asked to indicate the farm and owner/grower characteristics of passion fruit operations that participated in the survey. Farm characteristics included the following information:

• Farm location by state and county,

• Total farm acreage, acres planted with passion fruit, fruit-bearing acreage, acreage in 2019 and 2020, acreage available for expansion,

• Year of planting and type of passion fruit grown, and other crops grown,

• Passion fruit yield in 2021, percent of unmarketable fruit, and where the fruit was sold,

• Box or flat count of passion fruit harvested in 2021 and average price received per box or flat in 2021,

• The percentage of harvested fruit sold fresh,

• Additional agricultural activities,

• Value-added products from passion fruit and new markets.

They were also asked to provide information about the owners and operators, namely:

• Interest in passion fruit,

• Year born,

• Racial background,

• Gender, and

• Highest level of education.

Yields were asked only in 2021 to minimize errors due to the length of recall of passion fruit production in previous years. The entire survey can be viewed in the supplemental data included in an earlier publication[1].

-

The number of useable survey responses was from California (six), Florida (21), Hawaii (one), Louisiana (two), Mississippi (one), Puerto Rico (12), and the Virgin Islands (one). Survey data were divided into four regions (Table 1). The first region consists of 21 respondents from Florida. The second region consists of six respondents from California. The Puerto Rico region includes all 13 respondents from the island and the US Virgin Islands. The states of Hawaii, Louisiana, and Mississippi comprise the fourth region with four respondents.

Table 1. Distribution of passion fruit farms by region and state based on a national survey conducted in 2022.

Region Farms (No.) Proportion (%) Florida 21 47.7 California 6 13.6 Puerto Rico 13 29.6 Others 4 9.1 Total 44 100.0 The ordinal data were analyzed using chi-square to estimate frequencies and generate tables and figures. Overall and regional averages and standard deviations of cardinal data across categories were estimated by analysis of variance.

An empirical model was developed to determine the significant factors affecting production. The empirical model was estimated using the ordinary least square (OLS) procedure. The robust variance procedure calculated the OLS model in Stata 17 (StataCorp, College Station, TX, USA). Precise calculations of the sample-to-sample variations of the parameter estimates are attained with the robust variance procedure[11, 12]. The variance inflation factor (VIF) was calculated using the VIF procedure in Stata 17 to detect the possible presence of multicollinearity. The marginal impacts of the independent variables on computer usage were computed using the margins procedure of Stata 17.

-

The 2022 survey sample of 44 farms represents about 12% of passion fruit farms reported by USDA-NASS[2] in 2017. Respondents were asked how large their farming operations were, not just for passion fruit acreage. The participating farms reported a total farm size averaging 98 acres per farm (Table 2). There are considerable variations in the individual acres reported by the participating farms. The Florida farms averaged 159.5 acres per farm, followed by California with 78 acres per farm. The farms in Puerto Rico and other states operate smaller farm sizes (Table 2).

Table 2. Total farm acres and acres available for expansion.

Region Total farm acresns Acres available for expansionns Mean Std. Dev. Mean Std. Dev. Florida 159.5 473.3 9.3 21.8 California 78.0 108.5 3.5 5.2 Puerto Rico 25.4 39.7 3.7 4.5 Others 41.1 55.9 10.1 7.9 Total 98.0 331.7 6.9 15.6 ns – not statistically significant (α = 0.05). When queried about passion fruit production alone, all states estimated room for expansion, averaging 6.9 acres per farm with as many as 10 acres envisioned for expansion.

The average acreage dedicated to new passion fruit production rose from 1.7 acres in 2019 to 2.1 per farm in 2020 (Table 3). The average farm sizes in Florida, California, and Puerto Rico reported more new acreage devoted to passion fruit production from 2019 to 2020.

Table 3. New acres dedicated to passion fruit in 2019 and 2020.

Region Acres devoted to passion

fruit in 2019nsAcres devoted to passion

fruit in 2020nsMean Std. Dev. Mean Std. Dev. Florida 2.9 6.6 3.7 10.0 California 0.3 0.4 0.6 0.9 Puerto Rico 0.7 0.8 0.8 0.9 Others 0.5 0.0 0.5 0.0 Total 1.7 4.7 2.1 6.9 ns – not statistically significant (α = 0.05). Six responding farms from Florida and California revealed that the box count of passion fruit harvested in 2021 ranged from 10 to 48 fruits per box. About 7.1% of the reporting farms reported box counts of 10, 20, and 24 per box. Twenty-eight per box was reported by 21%. Approximately 14% stated that their box counts were 30, 32, and 35 per box. Forty and 48 per box were reported by about 7% of those who revealed their box counts. The growers from other states and Puerto Rico did not report box counts.

Among the ten growers who reported passion fruit prices during the survey, the average passion fruit price was

${\$} $ Table 4. Average price received by grower per box or flat of passion fruit produced in the 2021 growing season across several US locations.

Region The average price received per box or flat in 2021(${\$} $/lb)ns Mean Std. Dev. Florida 3.97 2.69 California 2.50 0.0 Puerto Rico 2.48 1.59 Others − − Total 3.08 2.03 ns – not statistically significant (α = 0.05). Table 5. Percent of harvested passion fruit sold as fresh and percent of farms that produced value-added products.

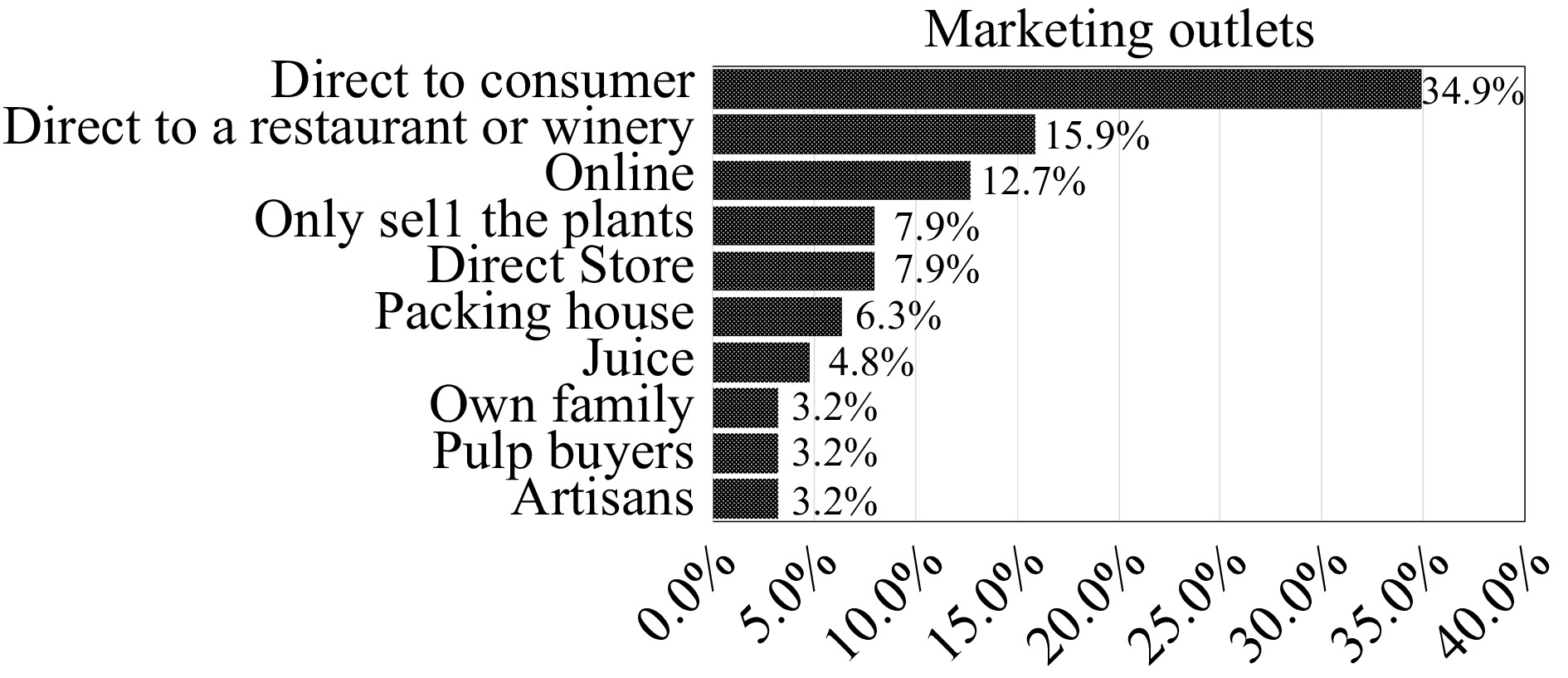

Region Percent of harvested passion fruit sold as freshns Percent of farms that produced value-added products* Mean Std. Dev. Florida 87.5 18.9 44.4 California 73.8 11.1 16.7 Puerto Rico 82.5 13.7 83.3 Others 90.0 0.0 50.0 Total 82.9 13.6 52.5 * – statistically significant at 0.05. Responses from 37 farms reported that more than one-third of the harvested passion fruit were sold directly to consumers (Fig. 1). About 16% were sold directly to restaurants, and 13% were sold online. The rest were sold directly to stores, packing houses, pulp processors the craft industry or used for familial consumption.

Figure 1.

Point of sale for passion fruit grown in the US ranked in order of greatest to least by percentage of the total sales market.

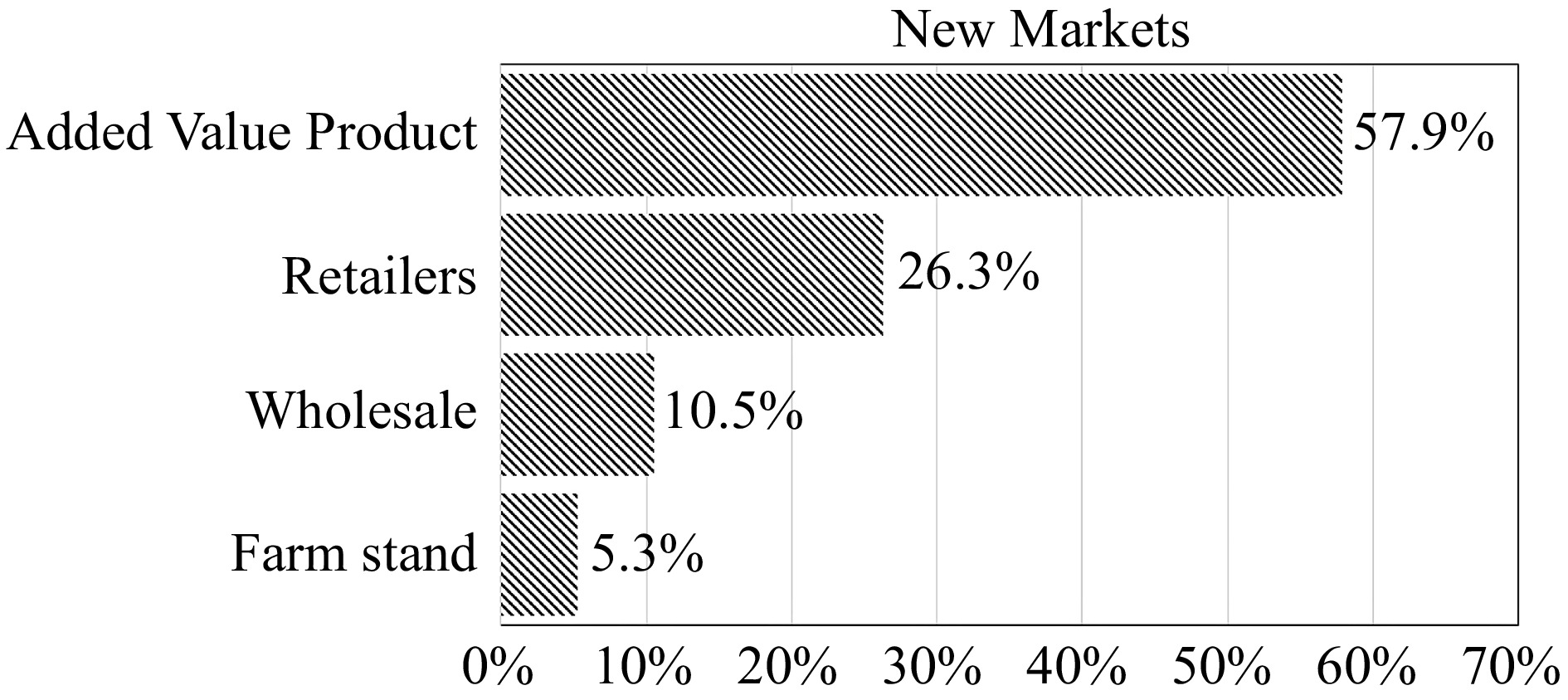

The 19 participating growers identified a need for new markets for the harvested passion fruit (Fig. 2). The suggested markets included processors, retailers, wholesalers, and farm stands.

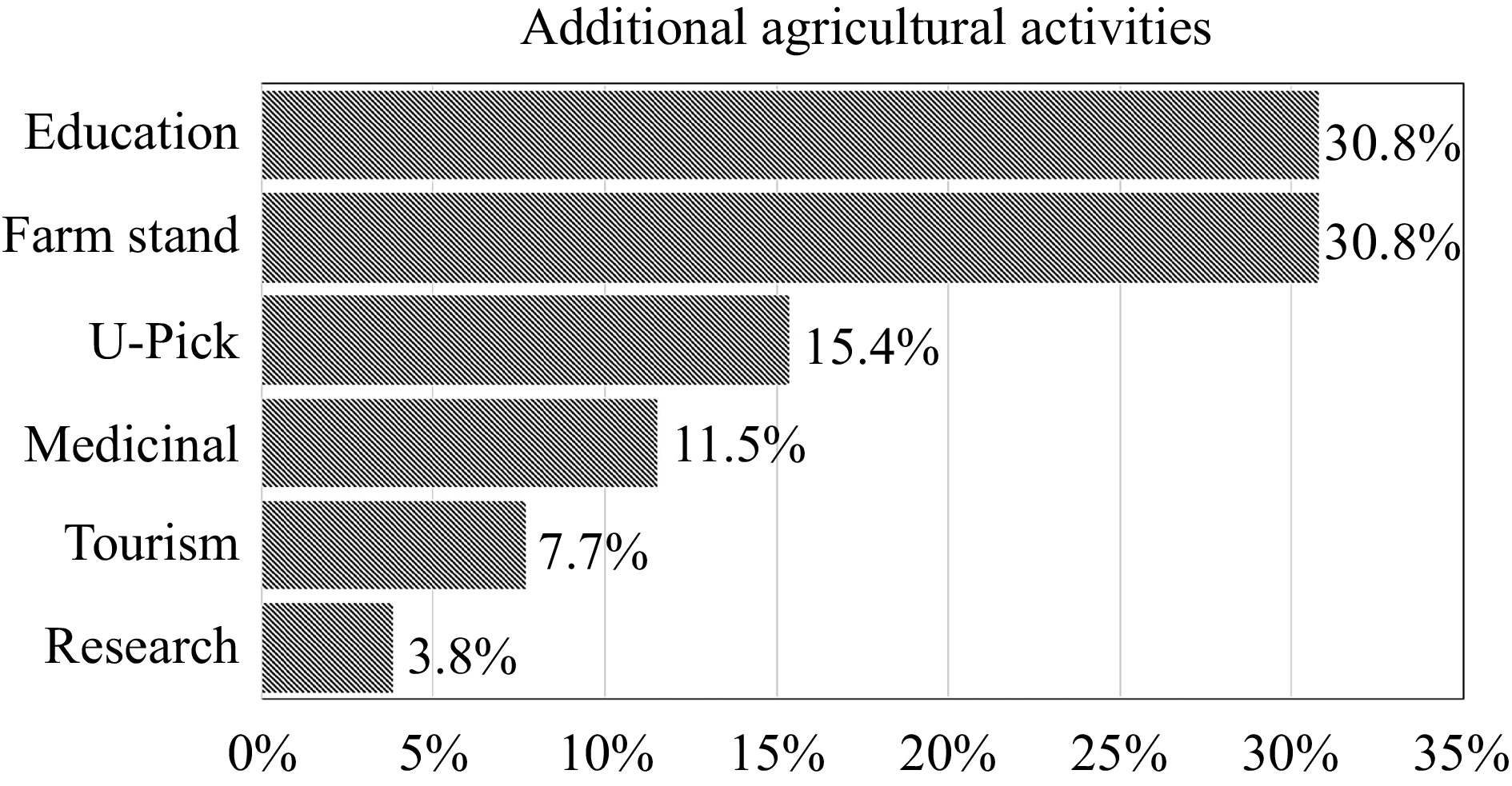

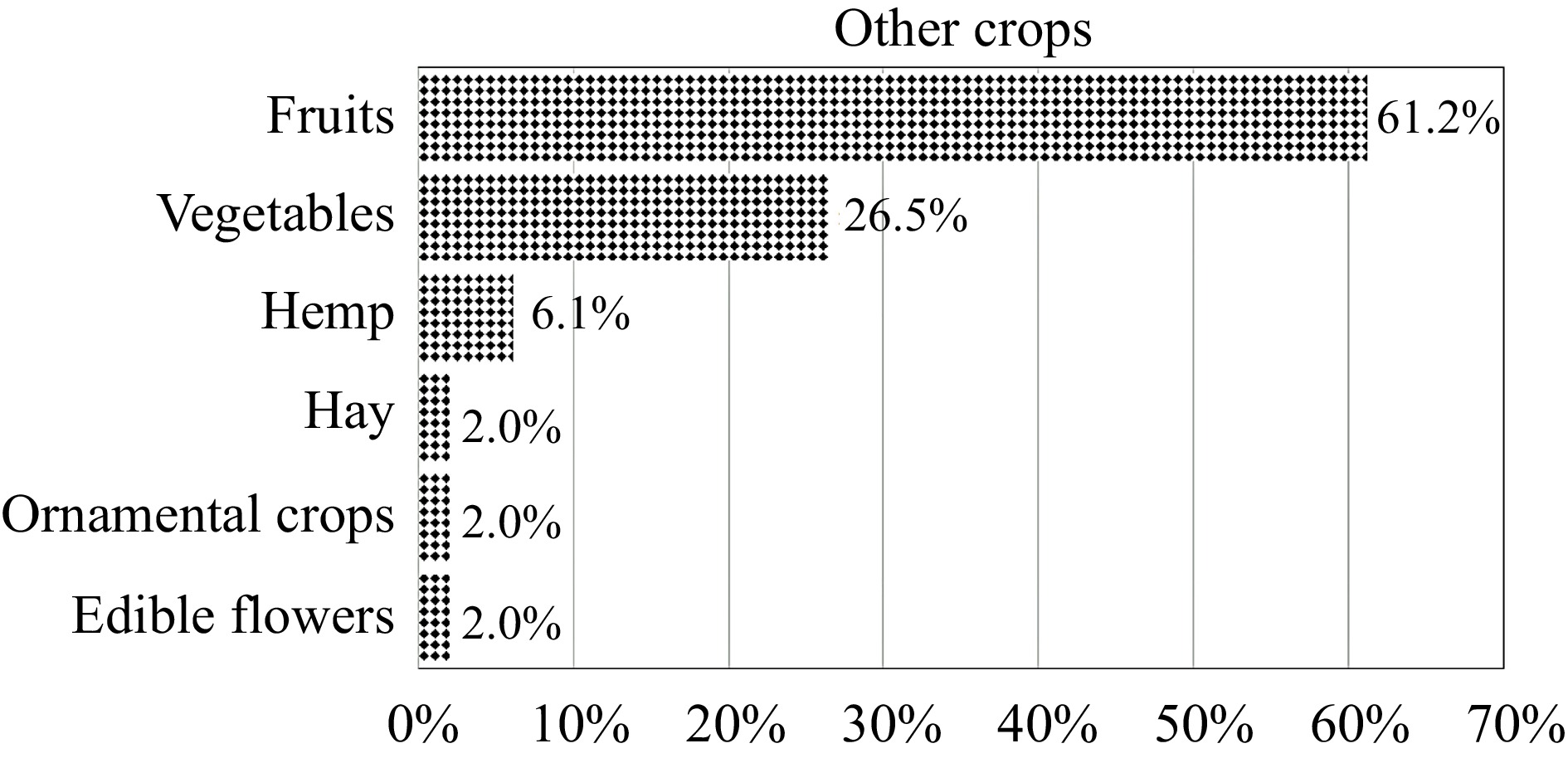

About 21 respondents are engaged in additional agricultural activities (Fig. 3). The main agricultural activities of the participants were education and farm stands. The remainder were engaged in U-pick operation, medicinal, tourism, and research. Other crops grown by the 38 respondents were mainly fruits (61%) and vegetables (27%, Fig. 4). Other crops included hemp, hay, ornamental plants, and edible flowers.

Grower/owner characteristics

-

The age of respondents was similar, averaging 53.2 years old (Table 6). Most of the 38 participating growers who reported their gender were male (71%). Half of the 38 growers who responded considered themselves as Hispanic, Latino/Latina, or of Spanish origin. Almost two-thirds were white, followed by multiple racial origins and American Indian (Table 7). The rest were Asian and African American. About 42.1% of the respondents had completed advanced or professional degrees. Almost 40% earned college degrees. Approximately 13% finished high school, and the rest had vocational education.

Table 6. The average age of passion fruit respondents.

Region Meanns Std. Dev. Frequency Florida 55.2 15.3 12 California 55.0 15.3 6 Puerto Rico 50.2 12.2 13 Others 53.5 22.0 2 Total 53.2 13.9 33 ns – not statistically significant (α = 0.05). Table 7. Distribution of respondents by racial origin.

Race Frequency Percent White 23 62.1 Multiple 6 16.2 American Indian 4 10.8 Asian 3 8.11 African American 1 2.7 Total 37 100.0 An attempt was made to estimate significant determinants of passion fruit production among the participating growers (Table 8). A couple of essential variables are identified with significant effects on production even with such a small sample size who reported production (23 growers). It makes sense that production differs by region and land holdings. The base region is Florida, with results showing that California and Puerto Rican growers have higher yields in 2021. Passion fruit farmers with more acreage with fruit-bearing trees also enhanced annual harvest in 2021. Adding the sociodemographic characteristics of the growers in estimating the production function did not result in significant effects.

Table 8. Regression results with the yield per farm in 2021 (in pounds per acre) as the dependent variable.

Independent variable Coefficient Robust standard error Region California*** 9093.805 1719.473 Puerto Rico* 5814.651 3015.328 Fruit-bearing acres in 2021** 503.081 135.941 Constant −622.038 574.196 Number of observations 23 Probability (3,19) 0.000 R-squared 0.391 *** - significant at 0.01, ** - significant at 0.025, * - significant at 0.10. -

This paper is based on 44 respondents to the survey of the passion fruit industry conducted in 2022. This sample size is 12% of the 364 passion fruit farms[2] in 2017 reported by the US Department of Agriculture. Florida was identified as the production location with the largest average farm size and tremendous potential for expansion, more than California and Puerto Rico (Table 2). Nearly half of the responses were from Florida (Table 1). This is due to a couple of factors: the project was heavily involved in that area (the workshop was held in Homestead, FL, USA in 2022)[1], and it is one of the few places where there is a substantial University extension and research program to reach growers. Puerto Rico completed about 30% of the surveys due to connections with the University of Puerto Rico. California and other states had fewer responses, mainly because it was more challenging to contact individual growers in those states.

This survey identified important farm demographic data of the current industry. The average price per pound received for fruit in Florida was the highest (~4), whereas California and Puerto Rico were similar (4), whereas California and Puerto Rico were similar ( 2.50) (Table 4). The reason for the difference is unknown but could be due to available market demand or market timing of fruit availability. Since a box/flat of fruit averages about 10 pounds, prices would average nearly 40 for Florida and 25 for California and Puerto Rico passion fruit. California grows mostly purple passion fruit, while Puerto Rico has mostly yellow passion fruit. The prices obtained were similar, potentially indicating no consumer preference based on color. However, more work needs to be done to determine the validity of that supposition. Most of the passion fruit produced in the US is for fresh consumption. Processed products like juice or nectars are mostly imported from South American countries, and competing with the scale of their output would not be economically feasible for US passion fruit growers. However, many respondents already produced or had a desire to add value-added products to their product line (Table 5). Many potential local value-added products could be developed to enhance the US passion fruit market. Much of the passion fruit in the US is sold directly to consumers (Fig. 1), including local fruit stands and similar businesses. Direct sales to restaurants were a much smaller component than the remaining options listed. Value-added is a substantial area of potential growth for the US passion fruit industry (Fig. 2), however, finding the products that will make an impact on consumers is vital. Imported value-added products are relatively inexpensive and mainly come in as juice. Creative opportunities for areas like dried fruit could be worth exploring.

The survey also identified grower demographics of interest. Many respondents were involved with education and farm stand sales (Fig. 3). Ideally, these two activities could be combined to deliver educational programming or literature to help expand the consumer knowledge base. Education is an intensive endeavor, and partnering with university extension would be a step toward alleviating potential bottlenecks in delivery for growers and farm stand operators. Most passion fruit farmers grow other crops as well. The majority grow other fruit crops, but some grow vegetables as well (Fig. 4). The management of passion fruit may be viewed as complementary to other fruit crops, or a business strategy may dictate that other crops be grown, such as the need for product diversification at a farmer producer stand. The average age of a passion fruit grower was more than 50 years (Table 5). While not surprising, it does reinforce a problematic situation for agriculture in general, namely the lack of younger generation involvement. On the face of it, this might appear to be an indictment of new generations' interest in agriculture. While that could be part of it, another serious aspect is the inordinate amount of capital needed to start a business[13]. Passion fruit in the US is not exceptionally well established, so taking it on as a new business endeavor is fraught with risk. Most respondents indicated they were of white origin, which is somewhat surprising since passion fruit is more well-known among Hispanic and Asian populations. The issue of economics may also play a role in who has the available funds to start and maintain a passion fruit business. More than 82% of the respondents completed at least a college degree, much higher than the 37% of the US population with a college degree in 2018, as reported by the US Census Bureau[14]. Half the growers considered themselves Hispanic, while almost two-thirds are white, followed by multiple racial origins and American Indian.

Our survey identified a strong desire to expand passion fruit acreage in all surveyed states. In 2019 vs 2020, plantings grew or remained constant for all surveyed regions (Table 3), and over the last 20 years, overall acreage has consistently increased[5,2]. While this is an excellent indicator for the industry, support from universities and other agricultural-related businesses needs to be augmented to meet the anticipated increase in production. Our data indicated that a significant amount of research needs to be conducted to address (a) viral diseases and passion fruit pest management, (b) propagation material availability and breeding advancement, and revised horticultural approaches that compensate for labor shortages and reduce input costs[1]. Further, the industry is still a number of years away from seeing crop planting maturity in many cases. California was the only state that reported all current acres were of bearing age and in fruit production. Others have more acreage ready to mature soon, but this will delay industry expansion in the meantime (as of the 2022 survey). Despite these challenges, we anticipate two factors that may allow passion fruit to gain a foothold. First, as the demographics of the US become more diverse[15], we anticipate shifts in demand for more exotic fruit in retail markets[16]. Second, consistent marketing and advertising[17] of the product's potential to consumers who are not traditional exotic fruit users seem likely to encourage greater demand going forward as people are more familiar with passion fruit and its uses in cooking.

-

The initial results of estimating the production function determine which factors are important and should be considered in promoting passion fruit production. It gives indications for further exploration for future research on passion fruit production. When the sociodemographic characteristics of the growers were added to estimating the production function, results showed that there are no significant effects on production. In addition, as suggested by earlier investigators[8], the marketing of passion fruit needs substantial research to promote the expansion of the industry in the US. Thus, the next research activity is to determine consumer preferences and their willingness to pay for fresh passion fruit and related products in selected cities in the US. A survey has already been developed and is being implemented during 2023. Updated information on the operational characteristics of horticultural farms is helpful for researchers, specialists, growers, lenders, and investors[10]. A group of agricultural economists and horticulture scientists prepared enterprise budgets for passion fruit operations in South Florida[13], and other products are in development.

-

The authors confirm their contributions to the paper as follows: study conception and design: Stafne ET, Blare T, Posadas BC, Downey L, Anderson J, Crane J, Gazis R, Faber B, Stockton DG, Carrillo D, Morales-Payan P, Dutt M, Chambers A, and Chavez D; data collection: Stafne ET, Blare T, Posadas BC, Downey L, Anderson J, Crane J, Gazis R, Faber B, Stockton DG, Carrillo D, Morales-Payan P, Dutt M, Chambers A, and Chavez D; analysis and interpretation of results: Posadas BC, Stafne ET, Blare T, Anderson J, Crane J, Gazis R, Faber B, Stockton DG, Carrillo D, Morales-Payan P, Dutt M, Chambers A, and Chavez D; draft manuscript preparation: Posadas BC, Stafne ET, Blare T, Stockton DG, Anderson J, Crane J, Gazis R, Faber B, Carrillo D, Morales-Payan P, Dutt M, Chambers A, and Chavez D. All authors reviewed the results and approved the final version of the manuscript.

-

The entire survey can be viewed in the supplemental data included in an earlier publication[1].

The datasets generated during the current study are not publicly available due to the confidentiality of limited responses but are available from the corresponding author on reasonable request.

We thank Mark Bailey, Andres Bejarano Loor, Ken Love, Jeff Wasielewski, and Haley Williams for contributing to this study. This work is supported by the Specialty Crops Research Initiative (Grant No. 2021-51181-35867/project accession no. 1027445) from the USDA National Institute of Food and Agriculture. Any opinions, findings, conclusions, or recommendations expressed in this publication are those of the author(s) and do not necessarily reflect the view of the US Department of Agriculture or any of the institutions involved in this study. Mention of a trademark, proprietary product, or vendor does not constitute a guarantee or warranty of the product by the US Department of Agriculture or any of the institutions involved in this study. It does not imply its approval to exclude other products or vendors that may also be suitable.

-

The authors declare that they have no conflict of interest.

- Copyright: © 2023 by the author(s). Published by Maximum Academic Press, Fayetteville, GA. This article is an open access article distributed under Creative Commons Attribution License (CC BY 4.0), visit https://creativecommons.org/licenses/by/4.0/.

-

About this article

Cite this article

Posadas BC, Stafne ET, Blare T, Downey L, Anderson J, et al. 2023. Grower and operational characteristics of US passion fruit farmers. Technology in Horticulture 3:25 doi: 10.48130/TIH-2023-0025

Grower and operational characteristics of US passion fruit farmers

- Received: 25 July 2023

- Accepted: 13 October 2023

- Published online: 04 December 2023

Abstract: In the United States and its territories, passion fruit production has increased steadily since the 2002 USDA agriculture census; however, little is known about the reported production areas and how the industry functions. This report details the results of a survey conducted in 2022 of passion fruit producers in the United States, including Puerto Rico and Hawaii. The aim was to collect data on farm operational characteristics, sales data, and grower demographics. Forty-four surveys were completed, with Florida having the most responses (21), followed by Puerto Rico (12) and California (six). Hawaii, Louisiana, Mississippi, and the Virgin Islands completed the remainder. This sample was 12% of the 364 passion fruit farms reported in 2017. The acreage dedicated to passion fruit production averaged 1.7 acres in 2019 and 2.1 acres in 2020 per farm, with most occurring in Florida. A box of fruit had around 30 fruits and a mean price of ${\$} $3.08 per lb. About 83% of the harvested passion fruit was sold fresh, although more than 50% of farms included sales of value-added products. Of the fresh fruit sold, 34.9% were sold directly to consumers. The respondents averaged 53.2 years old. More than eight out of ten respondents completed at least a college degree. Half the growers considered themselves Hispanic, while almost two-thirds were white, followed by multiple racial origins and American Indian. This data developed a greater understanding of the passion fruit industry within the US and will frame future projects to help grow this valuable specialty crop.

-

Key words:

- Passiflora edulis /

- Survey /

- Tropical fruit /

- Grower demographics /

- Farm operational characteristics